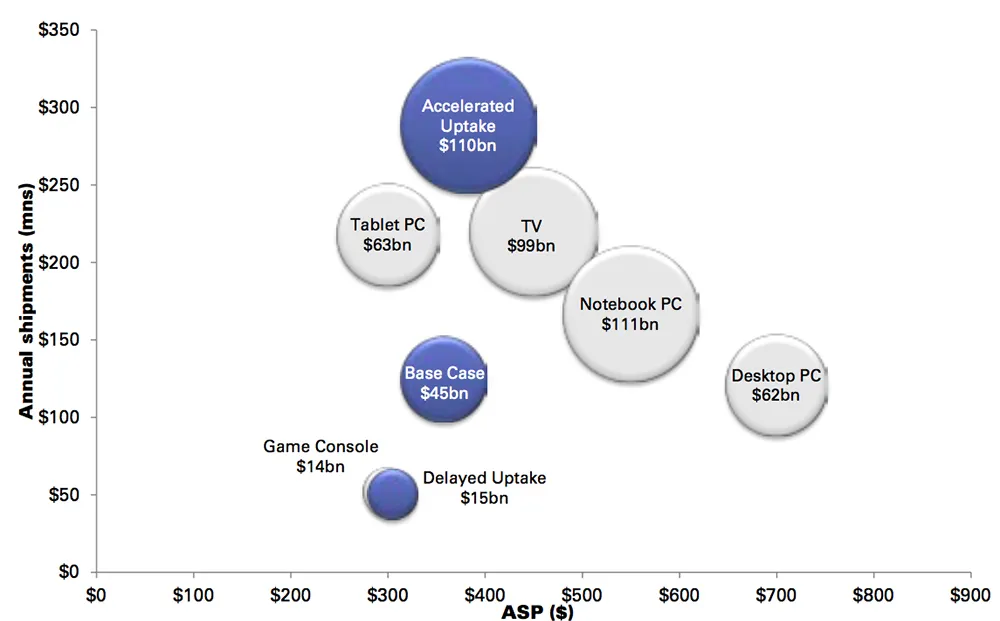

A report from Goldman Sachs projects VR generating as much as $182 billion in revenue in the year 2025. Of that estimate, $110 billion in revenue would be in hardware while $72 billion is from software. If the forecast is anywhere near reality, it would put VR on par with current spending annually on notebook hardware ($111 billion) and would dwarf the money spent on televisions ($99 billion).

The accelerated adoption scenario for virtual reality assumes head-mounted displays evolve “from a niche market device to a generic computing platform by 2025.” The scenario is presented alongside two others, one in which VR only becomes a $23 billion total market by 2025 because improvements to mixed reality technology occur slower “due to hindrance in adoption from latency, display, safety, privacy and other issues.” There’s also a kind of “goldilocks” baseline scenario in the middle “limited by mobility and battery life” that would make VR an $80 billion market ($45 billion in hardware and $35 billion in software). This goldilocks scenario would make the VR hardware market smaller in 2025 than the market is for tablet hardware today.

The 58-page report from Goldman Sachs was released on January 13 and represents the contributions of more than two dozen people. It outlines nine categories of VR software and the potential userbases in those categories, the largest of which is gamers. In the goldilocks scenario there would be 70 million VR/AR gamers in 2020 with 216 million VR gamers in 2025.

While the accelerated version of the forecast is sure to excite some VR enthusiasts I’ve spent too much of my day deciphering the assumptions in the report and have come up scratching my head about a number of things. It’s underscored for me just what a guessing game it is to project the adoption of a new industry — just last week another analyst shaved $30 billion off his projections for the VR/AR market.

As I break down some of the head-scratching assumptions I will focus on the potential market for gamers, as that’s what’s most immediately relevant in 2016 and likely to have a lasting impact on the adoption rate of VR.

First, check out these three charts:

Contained within these charts are many of the assumptions on which the report is based. Essentially, Goldman Sachs assumes over the next few years a growing percentage of people already on certain platforms (Steam, PlayStation, Xbox One) would buy VR hardware connected to that platform to enhance the investment they’ve already made. From the report:

We favor Sony’s PlayStation platform as an initial driver of VR penetration due to the high concentration of hardcore gamers on the platform, the likely seamless integration of the VR and host machines (due to the same company designing and selling the VR, software, and hardware), and content availability. Sony has announced its flagship racing title, GranTurismo, will be available on PSVR. Steam, in our view, is second most likely to penetrate VR gaming, with wide availability of content and its collaboration with HTC and Oculus.

The point about PlayStation is an interesting one but I don’t understand how Vive is cheaper to make than Rift or how Steam’s existing userbase helps it to be adopted more quickly than Rift. VR is a new medium and, to be worth buying, requires a lot of new games built from the ground up for the new paradigm. That has been the focus of Oculus from the moment it launched a Kickstarter campaign. Unfortunately, the way Goldman Sachs estimated the market potential based on existing platforms minimizes the potential impact Oculus could have contributing to the speed at which the VR market matures.

So when you get to the invidual estimates of how many devices are expected to ship this year, in the goldilocks scenario Goldman Sachs estimates 3.1 million wired headsets will ship in 2016: PlayStation VR with 1.5 million headsets, Vive with 1 million and Oculus Rift with 444,000. Even Microsoft gets into the game in the assumptions to ship 122,000 VR headsets. The accelerated scenario estimates nearly 6 million wired headset shipments this year with Vive shipping 3.1 million, PlayStation VR shipping 1.5, Oculus shipping 1.3 million and an unannounced device from Microsoft appearing from thin air to ship 733,000 units.

As a reality check, Rift is currently back-ordered six months and it was made available for pre-order two weeks ago. No other wired VR headsets are on sale yet and prices are not known. All in all, I am left with this gut feeling VR is on an accelerated adoption path that would make it larger than other categories of consumer electronics. However, without firm prices for PlayStation VR and HTC Vive I question the assumptions forming the basis of the Goldman Sachs estimates.

That said, enjoy some more charts: