The secrecy surrounding Valve Corporation in Bellevue, Washington is extreme.

Leaks are rare because the privately held game-maker is composed of only a few hundred people. This group is also the operator of Steam, which launched in the early 2000s and up until very recently enjoyed a 30 percent cut of many games sold through its PC games marketplace. This ballooning revenue source over the last decade led some to estimate Valve makes the most profit per employee of any company.

Most people don’t know that Valve’s engineers are also responsible for the “lighthouse” tracking technology that was key to HTC Vive’s first-to-market PC VR advantage when it launched in 2016. Tracked hand controls and room-scale movement freedom were essentially exclusive to Vive developers and customers for most of 2016. It wasn’t until December of that year when Facebook delivered a comparable experience with Oculus Rift.

In 2017, Microsoft partnered with PC manufacturers and built a line of low-cost Windows-powered VR headsets. While it served both Microsoft and Valve to make these Windows-based headsets work with Steam too, where does that leave HTC and its Vive headset if Valve builds its own?

I’ll get back to HTC in a bit, but for now I want to focus on two of the leading drivers of PC VR: Valve and Facebook.

Diverging Paths In 2019 For Facebook And Valve

While Valve leaks are rare, there was one recently showing a head-mounted display featuring a circuit board with the company name on it. This suggests Valve is developing its own head-mounted display which would likely be equipped with the second generation of its SteamVR Tracking technology.

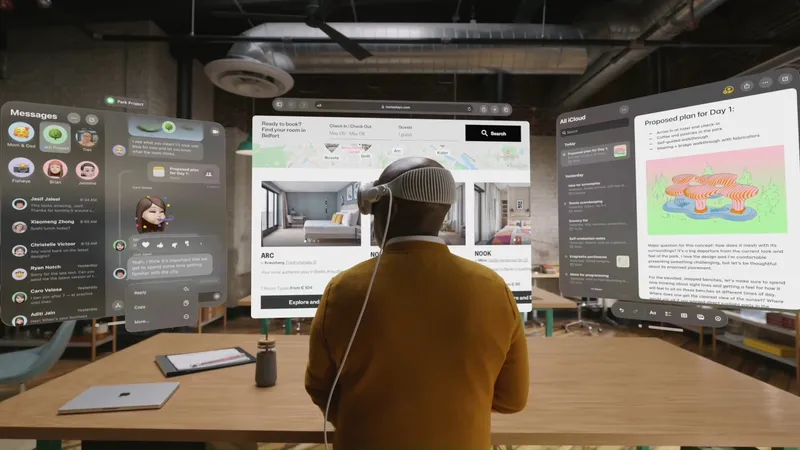

A Valve HMD with a wider field of view and hand-strapped Knuckles controllers, as well as upgraded room-scale tracking, sounds like a recipe for an incredible second generation PC VR development kit. Such a kit would seem to improve immersion in many ways relevant to developers who are exploring what it means to build virtual worlds for people to explore, work or play inside.

Critically, though, while such a headset might be perfect for inspiring developers it wouldn’t necessarily be what the VR market needs for significant expansion. To access a larger market, VR headsets need to lose the wired tether to the PC for convenience while also decreasing overall system cost.

This is where Facebook is aiming with its $400 Oculus Quest releasing early next year, hoping that among its 50-plus launch titles there will be enough compelling content to convince millions the headset is the right time to buy in.

On the PC side, Facebook’s priorities likely contributed to Oculus co-founder Brendan Iribe leaving the company. It is possible the so-called “Rift S” TechCrunch reported Facebook is building might use the Oculus Quest tracking system. This would allow Facebook to standardize on components, provide a consistent tracking experience across different Facebook headsets and make the overall setup of an Oculus Rift much more convenient compared with the original. This decision would likely also help Facebook leaders continue their apparent strategy of taking a loss on hardware in hopes of setting its Oculus Store as the default place to get VR content.

The next Oculus Rift, then, could combine the convenient setup of inside-out Microsoft-based headsets with the exclusive content Facebook funded over the last several years, all at a low price because Facebook doesn’t care to make any money on hardware at all.

Maybe the Rift S with “Insight” tracking makes the most sense to access a larger market, but will many creators build for that headset if developers discover they can do things with Valve’s hardware that can’t be done with Facebook’s?

Vive Pre Was Like Valve’s DK1

Oculus shipped two development kits on the road to making the consumer Rift. These kits — called DK1 and DK2 — certainly inspired a lot of developers to pursue VR software development. I’d argue an even larger number of prospective developers were actually turned away from VR by the flaws in these kits.

Some developers were only truly inspired when Valve revealed its lighthouse tracking technology, hand controllers and partnership with HTC to eventually ship the system to consumers. Valve, it should be noted, never sold developer kits. Oculus offered DK1 directly as a Kickstarter reward before moving on to the much-improved DK2.

Valve, meanwhile, handed pre-production Vive kits away to developers who might do something cool with it.

While HTC subsequently shipped the Vive, Vive Tracker and Vive Pro, Valve’s part in that process diminished the moment the first consumer Vive headsets shipped in April 2016. In my view, this means Valve’s upcoming HMD is essentially Valve’s DK2. If the Oculus DK2 represented a doubling of efforts to deliver compelling PC-powered VR hardware (and a working PC VR ecosystem for developers) then that’s exactly what this upcoming HMD represents from Valve.

Knuckles And A Wider Field Of View

For those unfamiliar, Valve’s Knuckles controllers are strapped to the hand and track all the finger movements so software can simulate the action of grasping and releasing objects.

This means the simple action of throwing a virtual ball should feel far more realistic and intuitive to people using Knuckles. For developers, that added sense of immersion could suddenly put game designs within reach that were infeasible before.

Add in the prospect of games made for the Valve HMD and Knuckles from the same people who built Portal and Half-Life, combined with support for Oculus Store content through the SteamVR bridge, and there isn’t a decision to be made for lots of the earliest buyers interested in upgrading to the next generation of PC VR.

A Valve HMD would bring buyers more content, better tracking than the first generation and, as developers release their Knuckles-enabled games, Valve HMD owners would get access earlier to some new games with more intuitive interactions. This is not to mention the prospect that a Valve HMD with wider field of view would let players spot more action in their peripheral vision.

If that’s what happens in 2019, I don’t think a “Rift S” that is cheaper than the Valve HMD will change the upgrade path for most people who purchased an original Oculus Rift or HTC Vive. I think the majority of buyers interested in upgrading would purchase the Valve HMD.

This means Facebook will be chasing whatever is left of the PC VR market after everyone else upgrades to the Valve HMD. Will a lower cost Rift S with great exclusive content draw in more new VR buyers and Rift upgrades than HMDs Valve will sell? I don’t know, but it seems doubtful.

Which brings me back to HTC.

This year HTC launched its Vive Focus standalone in China first and, given the fact that both Steam and Facebook aren’t directly supported in that country, HTC might be able to find success in that region. One big driver of that success would be western reluctance to do business in China that would directly support local censorship efforts. What that means long term globally is still unclear, but it is definitely a wrinkle in the evolution of this industry that will be interesting to see unfold over time relative to what Facebook, Valve and Microsoft do in 2019.

Pressure To Focus

Pressure is increasing on Valve and Facebook to deliver more compelling VR hardware.

For Valve, companies like Epic Games and Discord are threatening Steam’s dominance in the PC game’s marketplace. In developing competing stores, these companies are also targeting the 30 percent slice that Valve takes from the sale of games. Valve needs to make great games again or find another source of income beyond software if it wants to continue making as much money as it did over the last decade.

Even with Valve’s key revenue source being threatened, I argue that Facebook is in a more precarious situation overall. Remember that only a few hundred people work at Valve? In the last year, Facebook CEO Mark Zuckerberg engineered his organization to expand from employing 23,165 people near the end of 2017 to somewhere around 34,000 people at the end of 2018. This process of expansion will continue “in order to address various safety, security, and content review initiatives,” according to Facebook.

And then there are the risks.

“If we fail to retain existing users or add new users, or if our users decrease their level of engagement with our products, our revenue, financial results, and business may be significantly harmed,” Facebook’s public earnings report warns. “In the fourth quarter of 2017, we experienced a slight decline on a quarter-over-quarter basis in the number of daily active users on Facebook in the United States & Canada region. If people do not perceive our products to be useful, reliable, and trustworthy, we may not be able to attract or retain users or otherwise maintain or increase the frequency and duration of their engagement.”

The earnings report from Facebook also provides estimates for the number of “Duplicate” or “False” accounts using the social network, and warns that these “estimates may change.” As of the most recent earnings report, Facebook estimated in 2018 there are 2.27 billion monthly active users. The company also estimated, however, that in 2017 less than 15 percent of its accounts were “Duplicate” or “False.”

A company expanding headcount so significantly while also depending so much on estimates of “real” engagement seems like a recipe for turmoil and confusion. What Facebook’s decline could look like is also described in the risks section of its earnings reports: “a number of other social networking companies that achieved early popularity have since seen their active user bases or levels of engagement decline, in some cases precipitously. There is no guarantee that we will not experience a similar erosion of our active user base or engagement levels.”

Zuckerberg’s $3 billion gamble to purchase Oculus in 2014 was that he could offset this risk of precipitous decline in engagement for its social networking services by forging direct relationships with consumers who buy Oculus VR products. Those first products, though, were hobbled in various ways — Gear VR by its cell phone, Rift by its expensive PC and Oculus Go by its hand controller. Oculus Quest and its $400 standalone form factor with great hand controls represents the best chance Zuckerberg could still establish that direct relationship with consumers.

What this all means is that Oculus Quest appears to be a product that Facebook needs to be a success while Valve continues to work on a next generation product in a tight feedback loop with VR developers who want to push the medium forward. Could both Valve’s HMD and Oculus Quest find great success with VR in 2019? Maybe. But why would Facebook continue building new generations of Oculus Rift in a scenario that could see Quest find a larger install base in six months than Rift did in two years? Remember, Facebook is hiring thousands of employees to address the larger engagement issues on its social network. Does the company remain committed to Rift in that scenario?

The overall point here is that two of the drivers of PC VR’s first generation of innovation — Valve and Oculus — are facing very different external pressures in 2018 compared with five years ago. The commitment of leadership at these companies to this technology as an evolution of personal computing goes only as far as the success of their underlying business.

Correction: The sentence referencing Valve’s cut of sales was updated on Dec. 27, 2018 to account for Steam Direct. The sentence referencing support for Steam in China was updated on Dec. 28, 2018 to account for a partnership to bring a version of Steam to that country.