Virtual reality provides an unmatched ability to interact with financial information like never before. The finance industry is one of the most data-driven trades, and by visualizing and analyzing data in VR, early adopters can get a leg up on the competition. Not only can VR improve the way data is viewed, but it can also improve the level of communication through the use of a shared virtual office (SVO). This is immensely important because, in the high stakes world of finance, a mistake or lapse in communication could cost millions of dollars.

While consumer VR (gaming/entertainment) has led the charge for early adoption, businesses are beginning to see the benefits of VR. According to Forrester Research, “companies are already putting some of their big budgets into VR. Starting next year (2018), businesses will buy more mid-priced virtual reality gear than consumers will” and here’s why:

Data Is Being Wasted

Data is as good as gold when utilized correctly. Those who can process and analyze data better than others will have a significant advantage over the rest of the industry, which means better financial decisions.

If you’ve got data, USE IT! For many financial companies, relevant data is treated like actual currency, and visualizing this data in VR can reveal valuable insights into the market and help predict future trends. There’s millions to be made if you’re able to utilize data effectively, and analyzing big/complex data in a virtual environment makes it easier to identify the key trends and patterns.

The Connected World Needs Better Virtual Communication

With a virtual office, financial traders can interact with each other in the same space, thus improving the speed and quality of communication. Additionally, collaboration becomes easier as colleagues can see, in real time, exactly what the other is referring to. These improvements can save a lot of time, and as they say, “time is money.”

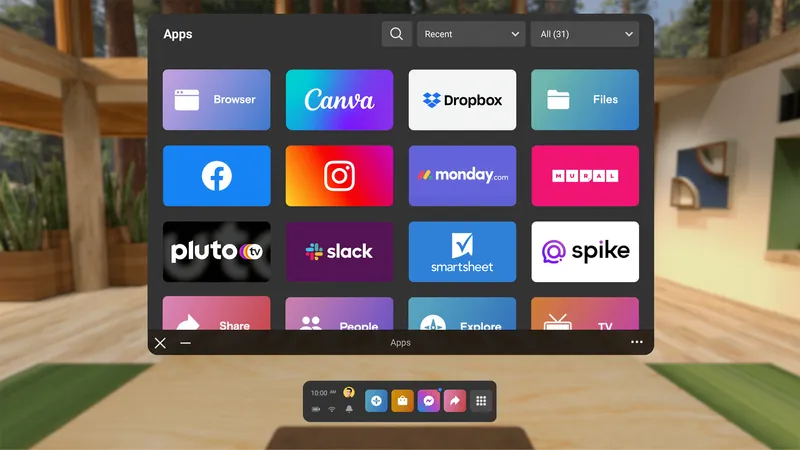

While effective communication is key for any organization, VR is also perfect for individual productivity with the ability to have a tremendous amount of information all around you with a 360-degree view. With a SVO, any workplace can instantly become the optimal space for productivity.

FinTech is Taking Over (Wealth Management)

Consumers are ditching the traditional banking system and finding alternative sources for investment advice. Companies like Fidelity Labs have taken note of this increase in FinTech and are utilizing VR to provide an easier way to visualize your portfolio. Finance is a very intricate industry and being able to visualize complex information through VR will bring countless advantages for consumers.

It’s clear that finance and tech are a match made in heaven. With the recent success and growth of the FinTech market, the finance industry is looking to technology, specifically VR, to get ahead. My advice – Make sure you’re not getting left behind.

Michael Amori is the co-founder and CEO of Virtualitics, a data visualization company based in Pasadena, California, that merges artificial intelligence, Big Data and virtual/augmented reality to gain insights from big and complex data sets. Previously he was Managing Director and headed a quantitative trading group at Deutsche Bank in London and New York.