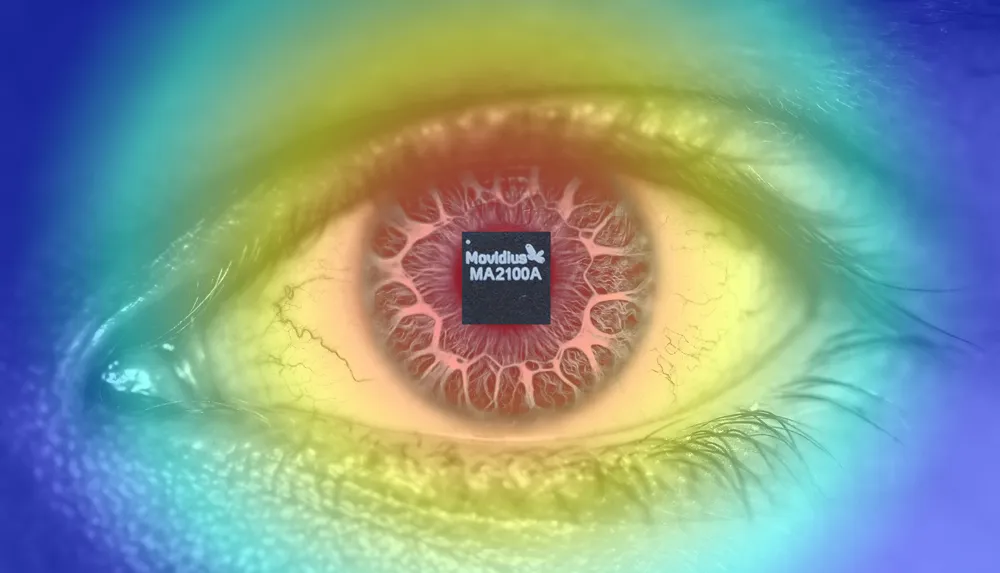

The stakes are high, and a failure to invest in the right technology today could have dire consequences for the technology industry’s biggest players tomorrow. With Intel’s planned acquisition of Movidius, which is expected to close later this year, it has never been clearer that the world’s largest chipmakers are seeing enough momentum in the market that they are ready to invest heavily in future generations of VR and AR technology.

The purchase of Oculus in 2014 by Facebook legitimized the industry, with Mark Zuckerberg tossing out $2 billion to purchase a VR startup and declaring shared experiences in virtual worlds as the future of socialization via the Internet. The acquisition accelerated investment in AR and VR startups, signaling to players like Google, Apple, Sony and Microsoft that another company would soon be entering the market for consumer electronics and personal computers. Two years later Facebook is still trying to realize the initial vision set forth by Brendan Iribe and Palmer Luckey, with the Oculus Touch controllers expected to arrive in the coming months to pair with the Rift.

Underneath two years of accelerated investment and innovation, however, has been an undercurrent of evidence that a wireless VR device with position tracking is what the market needs to truly take off. After getting the Gear VR out the door and helping Microsoft do the same with Minecraft for VR, we know Oculus Chief Technology Officer John Carmack is working on solving this problem in a future Oculus-powered headset.

This is the same problem Movidius could help Intel solve.

https://www.youtube.com/watch?v=zZBKJTLnp_A

Movidius is a closely watched startup we’ve been following because their sensors could be integral to VR’s next steps. Intel already outlined many of these next steps with the reveal of Project Alloy, targeting a late 2017 delivery of developer kits to partners. These features — likely not in consumer products from Intel until at least 2018 — include things like “inside-out” mobile position tracking, hand tracking and collision detection. All these features are dependent on new computer vision technologies delivered via chips and software that could, ideally, lower the cost of future systems by eliminating the need for an external camera or base station.

The biggest problem is that these “inside-out” technologies hog electricity. Who wants a VR headset that will only last a half hour before it needs to be charged again? Also, as we saw when the occupant of a Tesla Model S on Autopilot died after it slammed into a truck, computer vision technologies are still learning to understand everything that might be seen in the real world. Who will trust a headset that loses tracking in a room with a big window or mirror?

“[Movidius] may help future products come to market faster, but I don’t see it being a major accelerator especially when you consider how long chip acquisitions usually take to integrate,” said Anshel Sag, an analyst at Moor Insights & Strategy. “I believe that long term Intel is going to utilize Movidius’ IP to accelerate their position in wearables and other computer vision IoT applications like Drones and Automotive. I suspect that Intel will try to integrate Movidius in ways that help boost their current vision for IoT which includes using the data center to improve machine learning. But they will also use Movidius in ways that help them reduce power consumption at the edge with devices like Project Alloy.”

From Intel’s expensively produced “merged reality” marketing campaign through to this acquisition, it’s becoming clear the company whose founder described Moore’s Law, providing an accurate blueprint of the rest of the century, is betting pretty heavily that a number of manufacturers will be needing the company’s technology in the near future. In other words, Movidius could help Intel find VR’s holy grail.

“Intel’s acquisition of Movidius is strategically very sound as it both helps the company address their current IoT shortcomings as well as takes away a potential partner away from their competitors,” Sag said. “This is without a doubt one of Intel’s best acquisitions as of late.”