I spoke by phone this week with Meron Gribetz, the founder of Meta Company and its AR ambitions, and heard his explanation of what happened to the startup as it ran out of money over the last nine months.

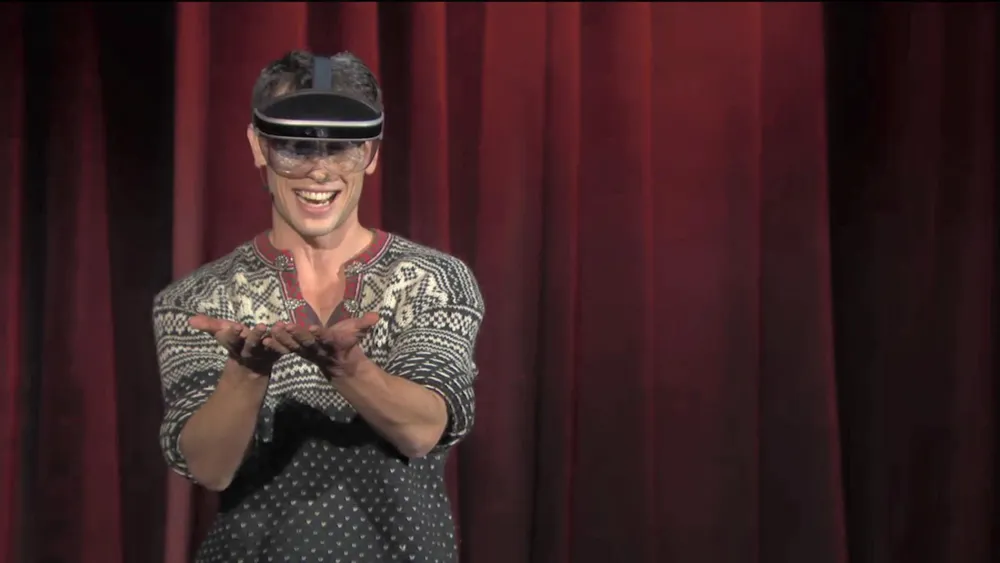

In case you are unfamiliar, Meta raised around $75 million, according to Crunchbase, with its largest $50 million Series B round announced a few months after Gribetz appeared in a TED talk in 2016 promoting the company’s Meta 2 AR headset and his concepts around human-computer interfaces.

Here’s how that TED talk came together, according to Stuart McFaul, the same marketing representative who worked with Gribetz to arrange a call with me this week:

Challenge:

Meta was an unknown AR company competing against Microsoft’s Hololens and Google-funded Magic Leap. Meta was preparing to launch their newest product after nearly a year delay and were without a marketing lead.

Solution:

Spiralgroup president Stuart McFaul stepped in as acting marketing VP. He led his tailored team on every aspect of launch events including all PR, social media, communications and advertising, along with presentation development and training. Helping to broker an on-stage debut at the 2016 TED Conference, the TED premiere received enthusiastic social media buzz, which Spiralgroup leveraged before launch. We negotiated a two-week “embargo window,” allowing Meta to fully brief dozens of top-tier media.

Results:

Meta’s launch received universally glowing reviews and established the company as a technology leader and darling in a space dominated by the “big guys.” Launch press alone generated over 200 million impressions worldwide, reflecting a 16x ROI for Meta’s original marketing investment at the time. Coverage has gone on to reach over 21 billion impressions.

Last year, it became apparent Meta was in trouble after a long period of silence.

Bloomberg reported in September that Gribetz furloughed employees after, he said, “The Chinese government sent an official request to our lead investor to re-evaluate the deal based on the recent actions from the Trump administration.”

Gribetz was unable to raise more money and a letter submitted last week in a patent infringement suit against the company revealed “Meta Company is insolvent.”

“The final step was that the bank which held our secured debt called the loan and sold the assets in a UCC sale to a private investor that I told you doesn’t want to be named right now,” Gribetz said on the call.

At its peak, Meta Company employed somewhere around 130 to 150 people, according to Gribetz. He declined to reveal key information including who bought the company, when the buyer might be revealed or how many Meta 2 headsets have been sold.

He did, however, answer some other questions.

Below is a transcript of the first section of my talk with Gribetz by phone. To save you time, though, I’ve also bolded the comments I found most interesting.

Meron Gribetz: Can you hear me?

Ian Hamilton: Yeah I can hear you.

Gribetz. OK. Perfect. Thank you. Alright. So. I’m at your disposal, let me know, you know, what answers I can [get] for you, you have a lot of questions on your mind, and let’s just jump right into it.

Stuart McFaul: Well do you want to frame out the news for him first, or?

Gribetz: Yeah. Yeah. Yeah. Absolutely. So, look the tagline that I think summarizes the whole story is the simple statement which is that, Meta has new owners basically. Meta has been sold to new owners. And its assets are safe and have a future of some sort, so that’s kind of the bird’s eye summary and with that in mind I can jump into exactly, you know, what happened, and you can also guide me with questions as to what you wanna hear about in particular. And I’m gonna be as transparent as I can. One thing that I can say is that, as I am no longer the owner of the company I have to respect the new owners who have requested confidentiality on a few different things. And so you know I apologize in advance if I can’t answer everything specifically about the future, but I can certainly explain what has happened under my jurisdiction as CEO of Meta that was in the past…so, that’s the introduction and I apologize if that feels incomplete. But I just want to let you know that I sought out this conversation, I want to, you know, tackle any questions that you have head on. So I’m here for you, let’s get started.

Hamilton: So can you say who the new owners are?

Gribetz: Yeah, so that was one of the things that they asked to prevent from disclosing, and I have to humbly follow that request.

Hamilton: When do you think that will be known?

Gribetz: They haven’t given us a date but you know I certainly made the request to give a date to you guys and I will get back to you shortly with the answer from them.

Hamilton: So can you walk me through the path of sort of trying to get another round of funding for Meta and ending up at this solution?

Gribetz: Yes absolutely…the summary is that for many months as the CEO of Meta I was working with a Chinese VC to invest a very large sum into Meta, and unfortunately kinda something that’s been reported on thoroughly and fact-checked by Bloomberg due to the China-U.S. trade war, the Chinese blocked the deal at the last minute, and as a result of this we began to run out of cash. So in September we furloughed the company and I tried feverishly to raise bridge financing to save the company. However, we were unable to attract new money and the company finally ran out of resources. And then the final step was that the bank which held our secured debt called the loan and sold the assets in a UCC sale to a private investor that I told you doesn’t want to be named right now. So that’s the context. That’s the specifics here.

Hamilton: Well can you clarify then did you have a choice in that outcome? Did you pick the person you sold to, or is that the process by which it changed hands?

Gribetz: The bank was the one who sold the company’s assets to the third party. It was not me. But I can’t say whether or not I had the choice but you can surmise that I wasn’t the primary party that was doing this.

Hamilton: So do you have any idea what your role is after this transition?

Gribetz: I can’t unfortunately comment about that. But I can say that my personal goal is what I said on the TED stage in 2016, is to put the strip of glass with light field and photo realism and immersion and especially intuitive natural user interface techniques on a billion heads. And independently of what I’m doing next or where its going to be, you know, I’m committed to doing that. So, those are the things that I can say right now about my next step.

Hamilton: Well, so…

Meron: I’m one of these guys that’s super passionate about our industry and…I’m not going to take a very big setback that occurred due to this trade war…

Hamilton: Well so…

Meron: I’m not going to take this as my final step. Yeah?

Hamilton: When you say assets of the company, what’s left after this process? And can you give me an idea of where Meta was when it was at its peak…

Gribetz: Sure. These are good questions.

Hamilton: How many people you had…

Gribetz: OK, yeah. Sure. We had assets that were transferred between the parties and those assets included everything that was public, and including some things that were not public that, you can imagine, you know, are future product lines. So those are the primary assets that were sold. And at peak we were above 100, and the exact number might have been close to 130, 150. So, you know, far smaller than The Magic Leap or the Microsoft team that is responsible for HoloLens. But, you know, I feel really — it’s hard to right now, and you know, at this juncture — but I feel kind of proud that we were able to build something that had a really, you know, was rated — for the visual part of our Meta 2 — as one of the best, for a fraction of the cost that our competitors have and a fraction of the team size, you know. So that’s all I can kind of [laughs] say about the past, but you know right now, I know the assets have a new home and I very much hope they do really well there.

Hamilton: What would you say was the biggest mistake? Or were there multiple mistakes?

Gribetz: There were definitely multiple mistakes that any first time CEO, or any person in a very tricky industry like VR/AR faces, but I think, the thing that caused this whole company to end up where it was, was, I mean let’s face it, American VC’s were not investing in AR/VR hardware plays for the last three years. Very few deals, or any significant ones, have been made. And Chinese VCs have been exponentially increasing their investments over the last few years. So, you know we had to go where the money is at. You know I was just at CES and 10 out of the 12 or so AR/VR companies that were on the floor were from China. So it was just kind of evident that the Chinese are really doubling down on this. So I focused on China as a funding source, and the trade war escalated faster than anyone could predict and that hurt us.